Gender Based Long Term Care Pricing

The insurance industry is famous for pricing risk, with Loyds of London being famous for insuring the the most outrageous things. Life insurance has long been cheaper for women than for men (at most ages) because men die more often, and at younger ages. Auto insurance is more expensive for teenagers learning to drive than others. Long-Term care was priced the same for men and women from 1974 to 2012. Starting in 2012, the companies all began to introduce pricing models that gave lower rates to men in exchange for higher rates for women.

Single Women Pay The Most

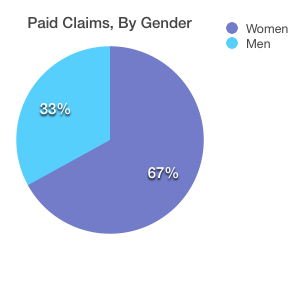

Fair or not, single women’s premiums can be as much as 80% higher than their male counterparts. Women account for almost 70% of Long Term Care claims, and tend to live longer to boot. So women’s premiums, with most insurance companies, are more expensive. This change first affected about 20 states, but by mid-2014 was active in 44 states. There are still some states with laws that prevent women from paying more than men for Long Term Care Insurance.

Discounts

There are numerous health and partner/martial discounts that can help reduce your cost for LTC insurance. Request a quote from multiple companies and see who favors your situation. For married women, there may be little to no impact in some of the Gender-based pricing models.

Supplemental Information

Additional information on Gender Based Long Term Care Pricing.

Long-Term Care Claims, By Gender

Request Florida Long Term Care Insurance Quotes Now.

Your free comparison quote includes:

1. LTC Report Card - Compare companies in Florida.2. Personalized Quotes Side-by-Side.

3. Product Brochures From Multiple Companies.

"I was concerned I may not qualify due to some arthritis treated by medications. Once I spoke with LTC Tree, I felt like I had a plan of companies that would accept me. Two months later, my application was approved and after a short Q&A with my agent I sent in the premium and put coverage in force. All is well.

Don B., Ft Myers Florida

Contact Us

3360 NW 24th Way, Boca Raton FL 33431

P: (850) 312-3800

About Us | Privacy Policy

Copyright 2014-2018.