LTC Report Card™

The average shopper for Long Term Care Insurance online is right at about 55 years old. While this age is a great time to be planning, it also means you are approximately 30 years from the average age of use on LTC policies. The strength of the company you select for your Long Term Care Insurance is of utmost importance.

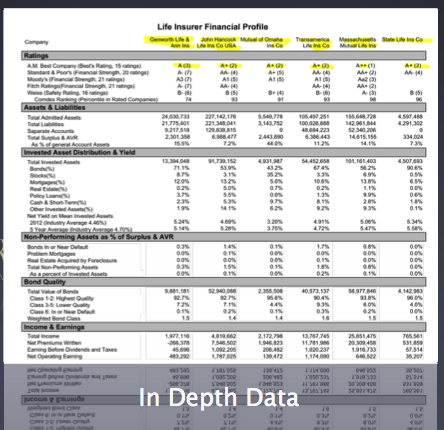

We have developed and refined our proprietary (and free) LTC Report Card™ as a way to analyze the past, present, and perhaps future strength of insurance companies you are considering quotes from. A lot of agents want to boil down a rating to an A or B or some other letter. More in-depth shoppers are looking for a bit more information.

- Ratings from 5 Agencies (A,A+,etc)

- Safety Ratings

- LTC Subsidiary Information

- Profit & Loss

- Investment Profile

- % invested bonds

- % invested stocks

- % invested mortgages

- 5-Year Yields

To request free, personalized comparison quotes and the LTC Report Card, simply click the button below "Start Free Quote" and we'll guide you through the information needed to complete your quotes.

Supplemental Information

Additional information on LTC Report Card™.

Our free quote packet includes not only your personalized side-by-side quotes, but also the LTC Report Card.

This in-depth financial analysis is designed for shoppers who are finance-minded to see clearly the details on the companies being considered.

Request Florida Long Term Care Insurance Quotes Now.

Your free comparison quote includes:

1. LTC Report Card - Compare companies in Florida.2. Personalized Quotes Side-by-Side.

3. Product Brochures From Multiple Companies.

"I was concerned I may not qualify due to some arthritis treated by medications. Once I spoke with LTC Tree, I felt like I had a plan of companies that would accept me. Two months later, my application was approved and after a short Q&A with my agent I sent in the premium and put coverage in force. All is well.

Don B., Ft Myers Florida

Contact Us

3360 NW 24th Way, Boca Raton FL 33431

P: (850) 312-3800

About Us | Privacy Policy

Copyright 2014-2018.