Tax Deductions and Tax Qualified Long Term Care Insurance

As with any financial planning topic, the implications of taxes should be understood before making purchasing decisions. When it comes to Long Term Care Insurance there are two major questions that need to be addressed: what are my tax implications now as a premium payer and in the future as a beneficiary. Tax topics are highly specific to your own status as a taxpayer, and the true answers to these questions can only be answered by your tax professional. Here are some general guidelines on the topic that may help open this discussion with your CPA and insurance agent.

The Now: Are Premiums Tax Deductible?

Long Term Care Insurance premiums may be tax deductible, but for many policyholders, premiums are not considered deductible.

-

Certain types of business owners may be able to deduct the premiums paid for LTC coverage by the business.

-

Health Savings Accounts may be used to pay all or part of your Long Term Care premiums with pre-tax dollars.

-

LTC Premiums are considered a health care expense (Source: IRS), which as of 2014 must exceed 10% of your Adjustable Gross Income. In prior years this limit was 7.5%

-

Many states have opted to provide deductions, and sometimes even credits for LTC ownership. Ask your agent about what's available in your state.

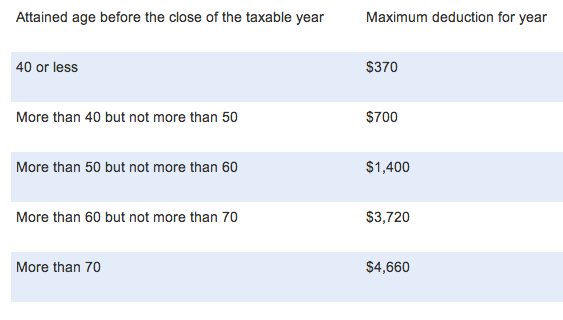

All of these deductions have limits, as outlined in the chart posted in the Supplemental section of this page.

The Then: Are Benefits Taxable as Income?

While the deductibility of Long Term Care Insurance varies dramatically based on your age, filing status, business ownership, and health, the tax-free nature of LTC benefits are more clearly defined. Tax Qualified policies have generous limits for tax-free benefit withdrawal. Since you may end up receiving claims in excess of $100,000 a year in the future, it’s good to know that your benefits won’t be showing up with a big tax bill to go along with them.

It is estimated that about 96% of annual-pay Long Term Care Insurance policies purchased since 2010 have fallen into the “tax qualified” category. Every traditional LTC plan we recommend at LTC Tree will be intended as Tax Qualified by the carrier, meeting the federal guidelines as defined by HIPAA in 1996.

Action Step: Request a Tax Qualified LTC plan comparison now.

Supplemental Information

Additional information on Tax Deductions and Tax Qualified Long Term Care Insurance.

2014 Limits for Long Term Care Tax Deductibility

These limits are increased each year by the IRS.

Request Florida Long Term Care Insurance Quotes Now.

Your free comparison quote includes:

1. LTC Report Card - Compare companies in Florida.2. Personalized Quotes Side-by-Side.

3. Product Brochures From Multiple Companies.

"I was concerned I may not qualify due to some arthritis treated by medications. Once I spoke with LTC Tree, I felt like I had a plan of companies that would accept me. Two months later, my application was approved and after a short Q&A with my agent I sent in the premium and put coverage in force. All is well.

Don B., Ft Myers Florida

Contact Us

3360 NW 24th Way, Boca Raton FL 33431

P: (850) 312-3800

About Us | Privacy Policy

Copyright 2014-2018.