Long Term Care Insurance Myths

1) The company can cancel my policy, for any reason. The insurance policy you get should have in bold letters on the first page the words GUARANTEED RENEWABLE FOR LIFE. This means that, no matter what may happen to you, your policy cannot be taken away from you. It’s a contract between the insurer and you. As long as you pay premiums every year, your coverage remains in force for as long as your pool of money lasts. Health changes and age changes will not disqualify your renewability of Long Term Care Insurance.

2) My coverage runs out at a pre-set number of years. Your coverage may be labeled as anywhere from 2-10 years but that does not necessarily mean that at that numbers of years, your coverage stops. Your “time limit” on a policy merely provides a mechanism for determining your pool of money. Let’s take a simple example: $100/day for 3 years. Doing the math, that’s $100 x 365 days x 3 years = $109,500 pool of money. If you make a claim and three years later have only spent $85,000 of your pool, the rest is there for you should you need continued care. They won’t stop payments at three years if you have available funds in your personal benefit account at the insurance company.

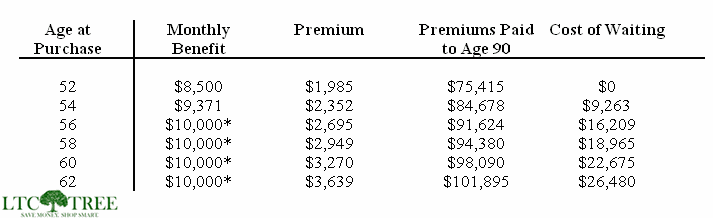

3) The best age to buy Long Term Care Insurance is after I turn 60. If we look at the cost of buying coverage at a younger age versus buying a policy at an older age, it would seem intuitively to make sense that paying less years of premiums would save money in the long run. Since a 50 year old would pay ten more years of premiums than a 60 year old, it would make sense that they’d pay more money over their lifetime. This is false. When we look at an example policy that pays $8,500/mo for 48 months ($408k pool) the cost is $1,985 for a healthy 52-year-old female. If she waited until she turns 62, the same coverage 10 years later will cost her $3,639.

We can see in this table that she actually spends about $26,480 more over her lifetime.

4) Men and Women pay the same for Long Term Care Coverage. As of 2013, most companies have rolled out “gender-based” pricing. Since women account for ? of claims, they are now paying more for coverage than men do. In fact, men’s premiums dropped in some cases when the new policies were rolled out. Read more here.

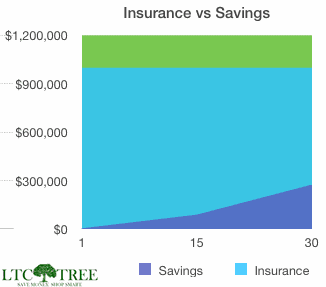

5) I’ll be better off saving the money versus putting it into a LTC policy. Let’s take a responsible 55-year old couple, Steve and Jill, as an example, who will end up needing Long Term Care at age 85. If Steve and Jill buy a $9,500/mo Long Term Care benefit with a pool of money of $576,000 per person, they have an immediate benefit of $1M. Their premium for this coverage is $3,952/year total. (Steve’s premium is $1,495 and Jill’s is $2,457) Rather than buying this policy and having $1M in benefits between the two of them, if they saved the same amount in an interest-bearing account at 5% after-tax (good luck!) they’d only have saved $275k in 30 years. If anything happened to them in the meantime, they’d have to pay it out of pocket.

There’s a very compelling case for buying Long Term Care Insurance as a hedge against accidents, both in the near-term and long-term.

6) Because of my health history, I won’t qualify for coverage. Even if you’ve had a history of cancer or are on medications to control heart conditions, you may qualify to buy LTC coverage. We have a more thorough page on eligibility requirements but would encourage you to give us a call if you are unsure. The representative who answers your phone call will be glad to pre-qualify you. Many conditions are perfectly acceptable in Standard rates after a waiting period, or well controlled on medications.

7) I will only need to use my coverage when I’m old! Unfortunately, the world is a random place with the possibility of accidents that could lead to needing LTC. Surprisingly, a significant portion of Long Term Care Insurance policy claims are made within just a few years of obtaining coverage. While the average age of use is in the mid-80s, claimants can be any age. By buying when young and healthy, you not only secure lower pricing versus waiting, you get peace of mind in case of an accident.

Request Florida Long Term Care Insurance Quotes Now.

Your free comparison quote includes:

1. LTC Report Card - Compare companies in Florida.2. Personalized Quotes Side-by-Side.

3. Product Brochures From Multiple Companies.

"I was concerned I may not qualify due to some arthritis treated by medications. Once I spoke with LTC Tree, I felt like I had a plan of companies that would accept me. Two months later, my application was approved and after a short Q&A with my agent I sent in the premium and put coverage in force. All is well.

Don B., Ft Myers Florida

Contact Us

3360 NW 24th Way, Boca Raton FL 33431

P: (850) 312-3800

About Us | Privacy Policy

Copyright 2014-2018.