How does Long Term Care Insurance Work?

Long Term Care Insurance can seem complicated, but when we examine the concept in its simplest form, it can be quite easy to understand. Let’s take Joe and Maria, a healthy couple aged 58. Joe and Maria have seen Joe’s parents (in their 80s) needing Long Term Care and are worried about how the family will manage and pay for the $8,000/mo cost that Joe’s parents are bearing out of savings. With a $150,000 nest egg, their savings will run out in just 19 months.

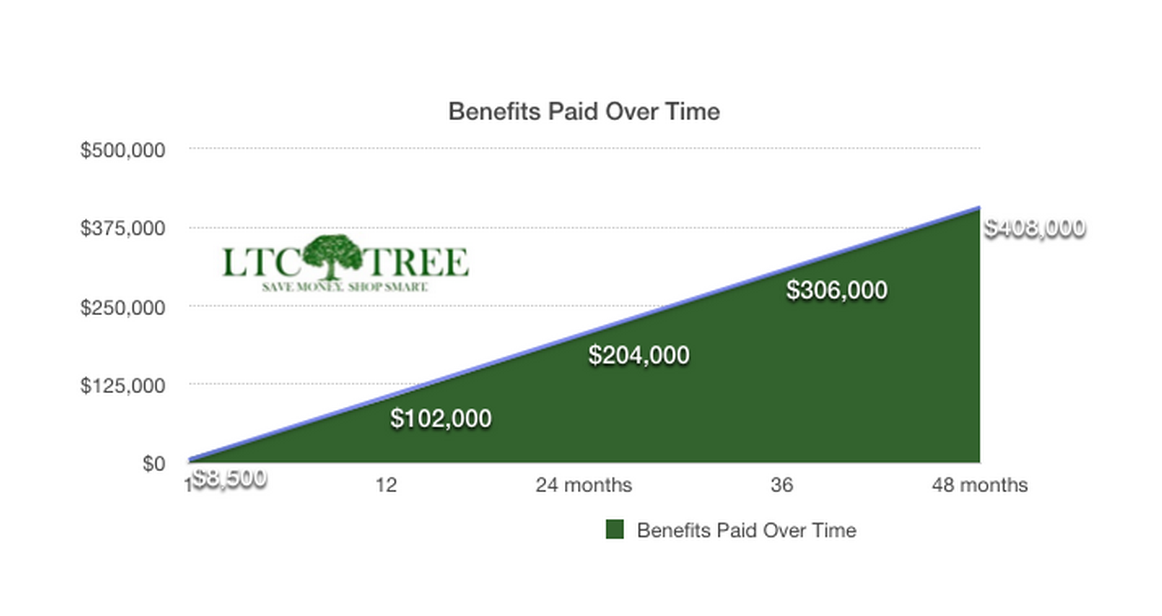

Joe and Maria elect to transfer the risk of needing Long Term Care to an insurance company. They buy a policy that will pay $8,500/mo per person, since costs in the future may be higher than today due to inflation. They want coverage that would pay for at least four years each.

$8,500 x 48 months = $408,000 Benefit Account Per Person

Here’s how the typical drawdown would look like, over the 4-year life of a typical claim:

So when and if Joe needs Long Term Care, he can expect to collect as much as $408,000 in benefits. This could all be drawn out as quickly as four years, or it could last him longer if the $408,000 personal benefit account was not depleted after four years.

Joe’s premium? Just $1,320/year.

The Problem Facing The Middle Class

The problem of Long Term Care and how to pay for it can be solved by either saving money religiously and keeping liquidity, or by buying Long Term Care Insurance. Only the mega-rich and ultra-poor should not consider Long-Term Care policies. The rich can easily afford to write a check for the high cost of care with little detriment to their overall savings. The poor may not be able to reliably pay premiums yearly, leading to policy lapses, which is not good for the consumer because all of the money put in the policy is lost if it is dropped. For the poor, state assistance is going to be the primary payer of Long Term Care. Once an asset level of $2,000 (yes, that low) is met, State Medicaid may pay for LTC services.

Savings Versus Insurance

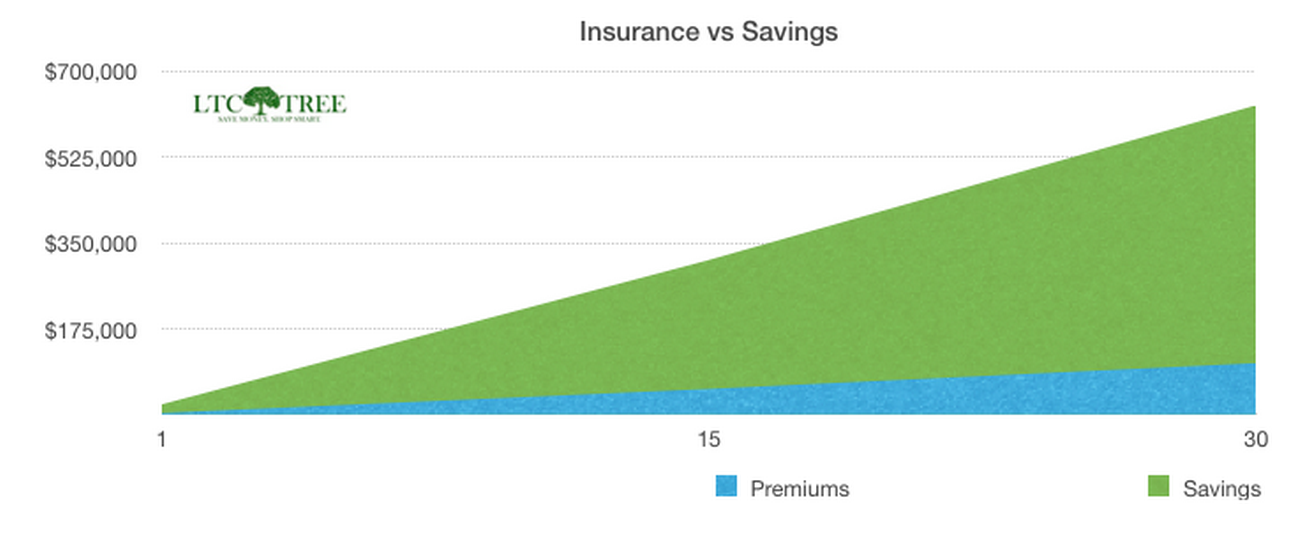

Why not self-fund the cost of Long Term Care? By saving money rather than pouring into insurance, you control your own destiny. While this can work, it requires significant sacrifice and discipline, and for many may simply be out of reach. Consider that in order to save $1M that a typical LTC policy may pay, a 55-year-old couple needs to save about $1,750 per month and earn an after-tax return of 3% compounded over 30 years versus an insurance premium of just $311. That $1,400/mo difference is pretty major for many people. In addition, as of 2014, there are few safe places that earn an after-tax return of 3%, so you are forced to take on investment risk to earn the returns necessary to self-fund.

As you can see in the chart above, there is really no comparison. Having a Long Term Care Insurance is of critical importance and the money saved versus put in premiums is just a tiny relative amount.

Request Florida Long Term Care Insurance Quotes Now.

Your free comparison quote includes:

1. LTC Report Card - Compare companies in Florida.2. Personalized Quotes Side-by-Side.

3. Product Brochures From Multiple Companies.

"I was concerned I may not qualify due to some arthritis treated by medications. Once I spoke with LTC Tree, I felt like I had a plan of companies that would accept me. Two months later, my application was approved and after a short Q&A with my agent I sent in the premium and put coverage in force. All is well.

Don B., Ft Myers Florida

Contact Us

3360 NW 24th Way, Boca Raton FL 33431

P: (850) 312-3800

About Us | Privacy Policy

Copyright 2014-2018.